ピックニュース

"Despite massive liquidation of Bitcoin long positions... Realized market cap surpasses $37 billion, signs of structural change"

概要

- Despite massive liquidation of Bitcoin long positions, the realized market cap of long-term holders has surpassed $3.7 billion.

- Along with the increase in realized market cap, over 4,000 BTC in Bitcoin withdrawals occurred on the exchange, raising concerns about a decline in liquidity and potential structural reorganization.

- The analyst predicted that if the movement of long-term holder funds continues, a sustainable bullish structure could be formed.

Recently, despite Bitcoin (BTC) falling below $101,000 and triggering large-scale long position liquidations, the realized market cap of long-term holders (LTH) has shown an increasing trend, raising the possibility of structural change in the market.

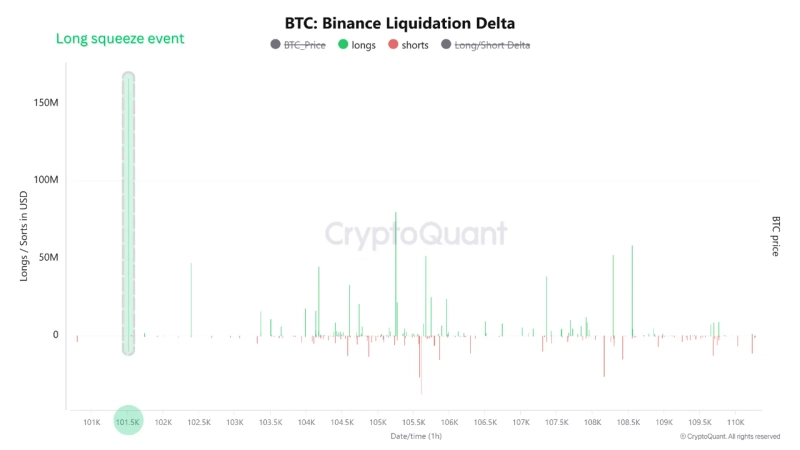

On the 7th, Amal Taha, an analyst at the virtual asset (cryptocurrency) analytics platform CryptoQuant, reported in a Quicktake report, "Recently on Binance, shortly after Bitcoin's price experienced a short-term decline, long positions amounting to approximately $160 million (about ₩2,200 billion) were liquidated," adding, "Most liquidation orders were clustered around the $101,000 level, and excessive leverage-based buy positions were intensively closed out."

In contrast, long-term holders lifted the realized market cap to over $3.7 billion. While the rise in realized market cap indicates the potential for some long-term holders to realize profits, it also signals ongoing capital rotation and structural reorganization in the market.

Additionally, over 4,000 BTC were withdrawn from Binance, indicating a shift in capital flows. The surge in withdrawals suggests a decrease in Bitcoin liquidity on the exchange, and at the same time, the possibility of external transfers for long-term holding is being considered.

The analyst predicted, "If these movements persist, long-term holders may be able to raise funds again and establish the foundation for a more sustainable bullish structure."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.