概要

- It was reported that the Bitcoin options market is exhibiting low volatility.

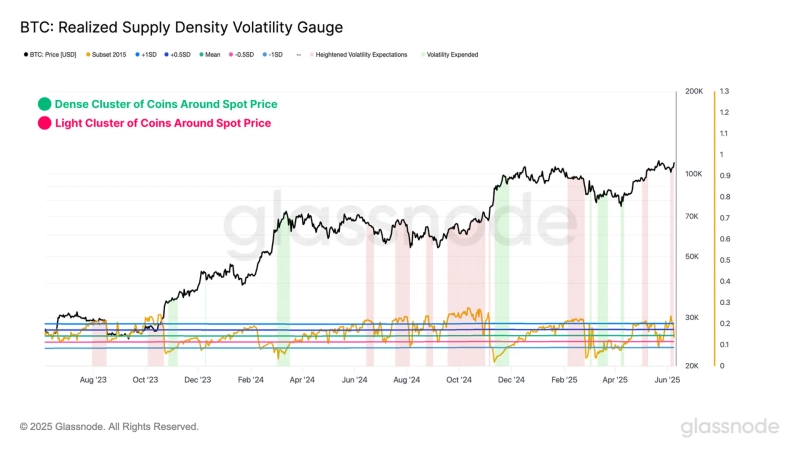

- The on-chain indicator Realized Supply Density suggests that increased market sensitivity may lead to higher short-term price volatility.

- Glassnode evaluated that complacency regarding volatility in the options market could actually signal volatility expansion.

The Bitcoin (BTC) options market is reflecting low volatility, while on-chain indicators are issuing warnings that the likelihood of short-term sharp price fluctuations has increased.

According to the cryptocurrency (crypto asset) specialized media NewsBTC on the 12th (local time), Glassnode, an on-chain analytics firm, cited the 'Realized Supply Density' data for Bitcoin in its weekly research report, stating that "the market sensitivity of Bitcoin is currently increasing," adding, "Even minor price fluctuations are impacting many investors, increasing the possibility of heightened volatility."

The report noted that this indicator has shown a steady upward trend over the past several weeks.

In contrast, the options market is showing the opposite trend. On this day, the implied volatility (IV) of Bitcoin options showed a downward trend in many intervals, indicating that market participants expect no major fluctuations for the time being.

Glassnode assessed, "Such 'complacency about volatility' has historically served as a leading indicator for volatility expansion," and "Currently, there is a phase where on-chain data and options market expectations are in conflict."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.