"JP Morgan Pours Cold Water on Kakao's Rally... 'Difficult to Justify the Share Price'"

概要

- JPMorgan reportedly downplayed the recent sharp increases in Kakao Group shares, especially Kakao Pay, stating that it is fundamentally difficult to justify.

- JPMorgan stated that it is premature to designate Kakao Pay as a beneficiary of the KRW stablecoin policy and noted that there are significant uncertainties involved.

- JPMorgan presented an investment opinion of underweight for Kakao Pay and neutral for Kakao Bank and Kakao.

Recently, JPMorgan, a foreign investment bank, downplayed the recent surge in Kakao Group's stock prices, calling it an "unjustifiable sharp rise in stock prices."

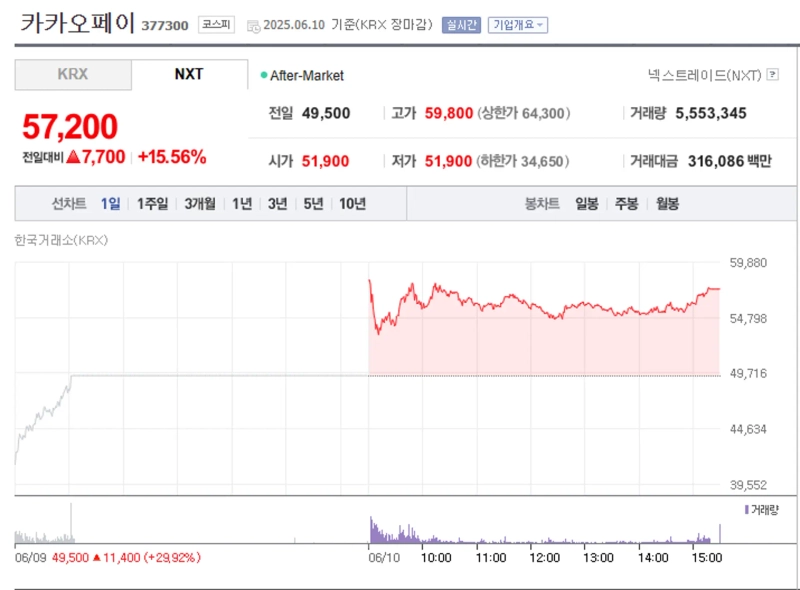

According to the Korea Exchange on the 10th, Kakao Pay's share price has surged by 95.24% over the past month. During the same period, Kakao rose 35.32% and Kakao Bank increased by 24.89%.

The recent surge in Kakao Group shares, led by Kakao Pay, is due to growing expectations that discussions on the introduction of a KRW stablecoin will become active after the launch of the Lee Jae-myung administration. If a KRW stablecoin is introduced, it is expected that digital payment platform companies such as Kakao Pay and Toss will benefit. On the 6th, momentum for the share price increased when Kim Yong-beom, former First Vice Minister of Finance who has advocated for the introduction of a KRW stablecoin, was appointed as the first Chief of Policy at the presidential office.

However, JPMorgan pointed out that "it is fundamentally difficult to justify Kakao Pay's surge" on this day. JPMorgan added, "It is premature to designate Kakao Pay as a beneficiary of the KRW-based stablecoin policy" and "There is still significant uncertainty regarding the introduction of stablecoins."

The firm also analyzed that the effect of the regional currency voucher policy would be minimal. JPMorgan stated, "Policies to stimulate consumption through regional currencies are one-off measures," and "It will only increase Kakao Pay's operating profit this year by about ₩3 billion." For a company with a market capitalization of ₩6.7 trillion, this is not a meaningful level.

JPMorgan criticized, "The recent rise in Kakao Group's shares resembles the surge in late 2022 to early 2023 that was driven purely by expectations, not performance." In addition, they presented an investment opinion of underweight on Kakao Pay and neutral on Kakao Bank and Kakao.

Nevertheless, despite these criticisms, Kakao Pay jumped 15.96% to close at ₩57,400 on this day. Kakao and Kakao Bank fell by 2.72% and 2.74%, respectively.

Reporter Shim Sung-mi

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.