美・日・英 are reducing, EU・China are increasing…Diverging government bond maturity strategies [Global Money X-File]

概要

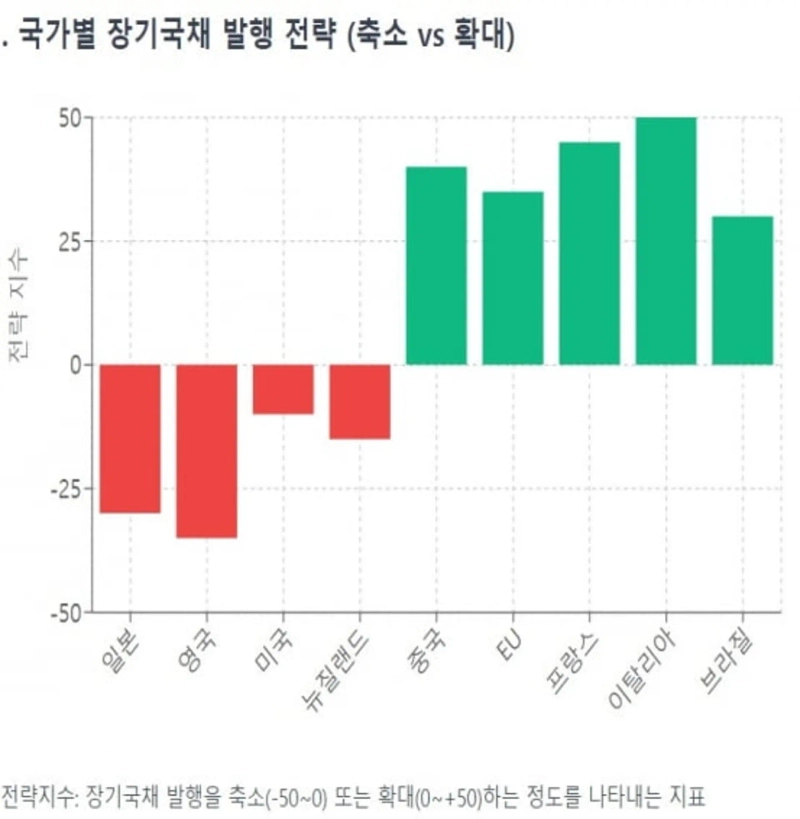

- Japan, the US, and the UK are reportedly adopting strategies to reduce or freeze the scale of long-term government bond issuances.

- By contrast, the European Union, Germany, and China are reportedly expanding their long-term bond issuances in line with large-scale infrastructure and stimulus policies.

- Depending on the choice of government bond maturities, various investment risks such as interest costs, rollover risk, and sovereign credit ratings may arise.

Recently, government bond policies in major global economies have been diverging. Japan, the United Kingdom, and the United States are maintaining or reducing the issuance scale of long-term bonds with maturities over 20 years. In contrast, the European Union (EU), Germany, and China are aggressively expanding their long-term bond issuances. These moves reflect the complex interplay of each country’s economic conditions, monetary policies, and changes in investor preferences. Generally, nations with high interest burdens have preferred short-term bonds, while countries launching large-scale government projects have expanded long-term bond issuances.

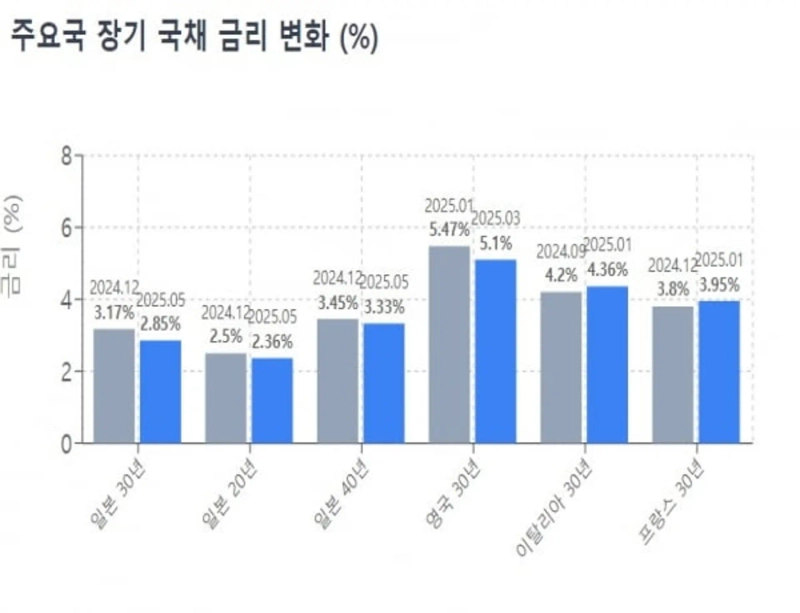

According to Reuters on the 9th, the Japanese government is considering reducing the issuance of long-term bonds such as 30-year and 40-year maturities. Since the end of 2023, signs have emerged that the Bank of Japan (BOJ) will scale back bond purchases, causing long-term interest rates to spike. As a result, the Japanese Ministry of Finance has reportedly reviewed its maturity structure to correct imbalances in the government bond market. An official from the Japanese Ministry of Finance stated, "If investor demand slows more than expected, we will also consider reducing ultra-long-term bonds."

The United States has recently refrained from expanding long-term bond issuance. Since the second half of 2023, the US Treasury has kept the size of long-term government bond auctions (10 years or more) unchanged for five consecutive quarters. US Treasury Secretary Scott Bessent stated in February, "We will not change Treasury issuance plans for the next few quarters." This contrasted with the view of some experts who saw boosting long-term issuance as inevitable at the time.

On the other hand, a USD 70 billion auction of 5-year US Treasuries held on the 28th of last month reportedly went well. The coupon rate was 4.071%, lower than expected, implying strong demand without the need for higher rates. In contrast, the USD 16 billion 20-year Treasury auction on the 21st saw the coupon rate reach 5.047%, the highest since the 20-year note was reintroduced in 2020, indicating weaker demand for long-term US paper.

Earlier, in March, the UK announced a cut in the proportion of long-term bonds in government bond issuance for the 2025–2026 fiscal year. The UK Debt Management Office stated, "The proportion of bonds with maturities over 15 years will fall from 20% to 13%."

Meanwhile, an increasing number of countries are boosting long-term bond issuance. The European Commission is issuing large-scale joint EU bonds to raise funds with member states. In March, it issued EUR 7 billion of 25-year NextGenerationEU (NGEU) bonds, receiving orders of about EUR 86.5 billion—over 12 times the issue size.

Germany, which has traditionally maintained a conservative bond issuance policy, is also expanding its 30-year bond issuance. In December 2023, the German government announced it would increase the 30-year bond issuance from last year’s EUR 2.2 billion to EUR 2.6 billion this year. Rohan Khanna, Head of Rates Strategy at Barclays, analyzed, "This German 'fiscal awakening' will help resolve collateral shortages and substantially change Bunds’ status in the European bond market." The French government issued EUR 10 billion of 30-year bonds in January, attracting orders more than 13 times the issuance.

China is also gearing up for large-scale long-term government bond issuance this year. In its ‘2025 Government Work Report’, the Chinese government announced, "Special ultra-long-term government bonds with 20, 30, and 50-year maturities will be issued at a total scale of CNY 1.3 trillion." This is CNY 300 billion more than last year (CNY 1 trillion) and will be divided into 21 auctions from April to October this year. The 50-year bond auction (CNY 50 billion) held on the 23rd of last month saw a bid yield of 2.10%.

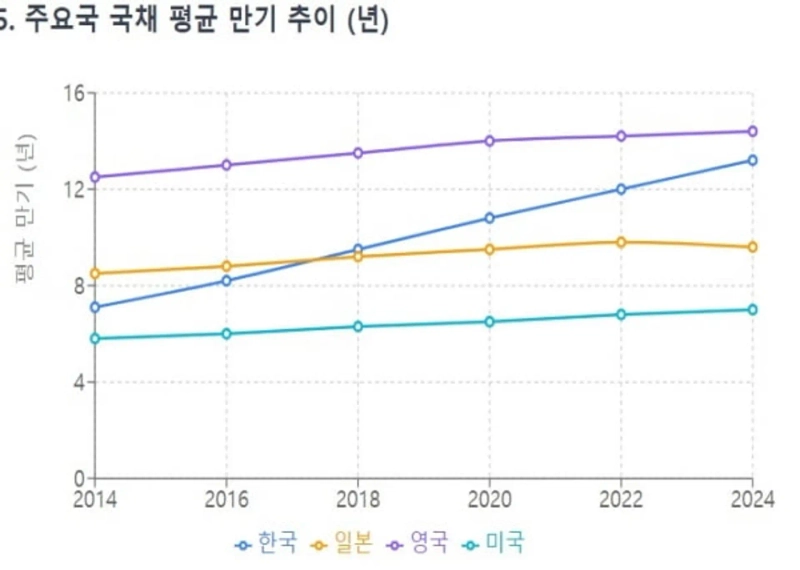

There are two main reasons why government bond issuance policies differ by country. First is the shift in investor types. Traditionally, pension funds and life insurers have been major buyers of long-term government bonds, but have recently become reluctant to invest. In Japan, life insurers and banking trusts have shifted strategies due to prolonged low rates, resulting in decreased demand for 20–40 year bonds.

In the UK, the 2022 pension fund crisis related to liability-driven investment (LDI) strategies had a significant impact. Soaring rates prompted large-scale margin calls for UK pension funds using leveraged LDI tactics, pushing the long-term government bond market to the brink of collapse. Since then, pension funds have scaled back leveraged investments in long-term bonds, causing demand for 30–50 year maturities to sharply decline. The UK Debt Management Office announced in March, "UK pension and life insurer demand has substantially decreased in recent years."

Differences in each country's interest cost and fiscal strategy also drive divergence. Extending bond maturity secures long-term fixed rates but increases up-front interest costs. Issuing shorter-term bonds provides cheaper funding in the short run, but heightens future interest rate risk.

If fiscal authorities prioritize stable fixed-rate funding, long-term bonds are favored. When minimizing immediate interest costs, short-term bonds are preferred. Japan and the UK have both recently leaned toward shorter maturities to restrain rising government borrowing costs as interest rates rise. The US is following a similar path; with overall national debt ballooning, it prefers short-term bonds to curb surging interest costs.

By contrast, Germany, the EU, and China face different circumstances. These countries are undertaking large projects for the future. In March, the German parliament approved a constitutional amendment for an unprecedented EUR 500 billion stimulus package focused on infrastructure and defense. China is also rolling out massive fiscal stimulus for economic recovery. Special ultra-long-term government bonds, first introduced during the COVID-19 outbreak in 2020, have been used to finance infrastructure investments.

Each approach brings its own risks. Increasing short-term issuance raises rollover (refinancing) risk. If there is a sudden jump in rates or a liquidity crunch, funding costs can soar. Recently, the US has faced rollover stress; every time the US 10-year Treasury yield approached 4.5% after former President Donald Trump announced reciprocal tariffs in April, the administration rolled out measures to ease tariff pressures.

Increasing long-term issuance raises the average cost of government borrowing and can negatively affect a nation's credit rating. This is why Fitch downgraded China's credit rating last month.

The global government bond 'duration divide' is likely to persist. Europe and China still need large amounts of funding without major interest rate fluctuations, supporting ‘long maturity, locked-in rates.’

Japan and the UK already have long average bond maturities, and their central banks are maintaining quantitative tightening. There is little incentive to borrow for even longer periods. Japanese Finance Minister Katsunobu Kato explained last month, "If rates rise, government interest payments increase and put pressure on policy finances." Moreover, the core investor base is shrinking, so the short-term bond preference is likely to continue.

Reporter: Juwan Kim kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.